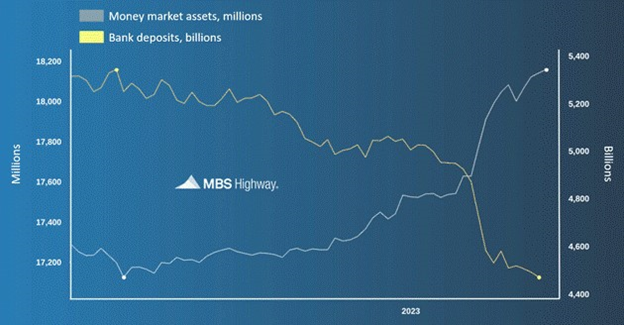

As we know, interest rates have two sides: the rate you pay and the rate you earn. With the Fed raising short-term rates substantially over the past year or so, some fantastic rates are available on money markets and short-term CDs. By moving cash around, savvy depositors can earn as much as 16x return (going from a paltry .25% rate to 4.25%). That’s an extra $4,000 per year on a $100,000 deposit! Just check out the chart below to see the flow.

This movement of cash to higher-yielding accounts, however, is creating a downside in the mortgage market. When depositors make such adjustments, banks may sell assets to raise cash and meet reserve requirements. (Banks may also increase their rates.) Some of the assets that banks sell are Mortgage Backed Securities – bond investments that set mortgage rates daily. This aggregate selling causes pressure for mortgage rates to increase.

The trend of deposits fleeing to money markets is leveling off, but news of this hasn’t reached the general public yet. So, with CPI inflation running at 3.0% and money markets available above that, this is a solid way to park some of your short-term idle cash that may otherwise be eroding to the effects of higher prices.